Investment Scheme

The LPDP Fund Development Services invest in deposits, government bond (SUN), and SOE bonds. The investment scheme maintains the nominal stability of the endowment funds in the future. The returns on invested funds are reported as Non-Tax State Revenue (PNBP) used to finance LPDP services and operation.

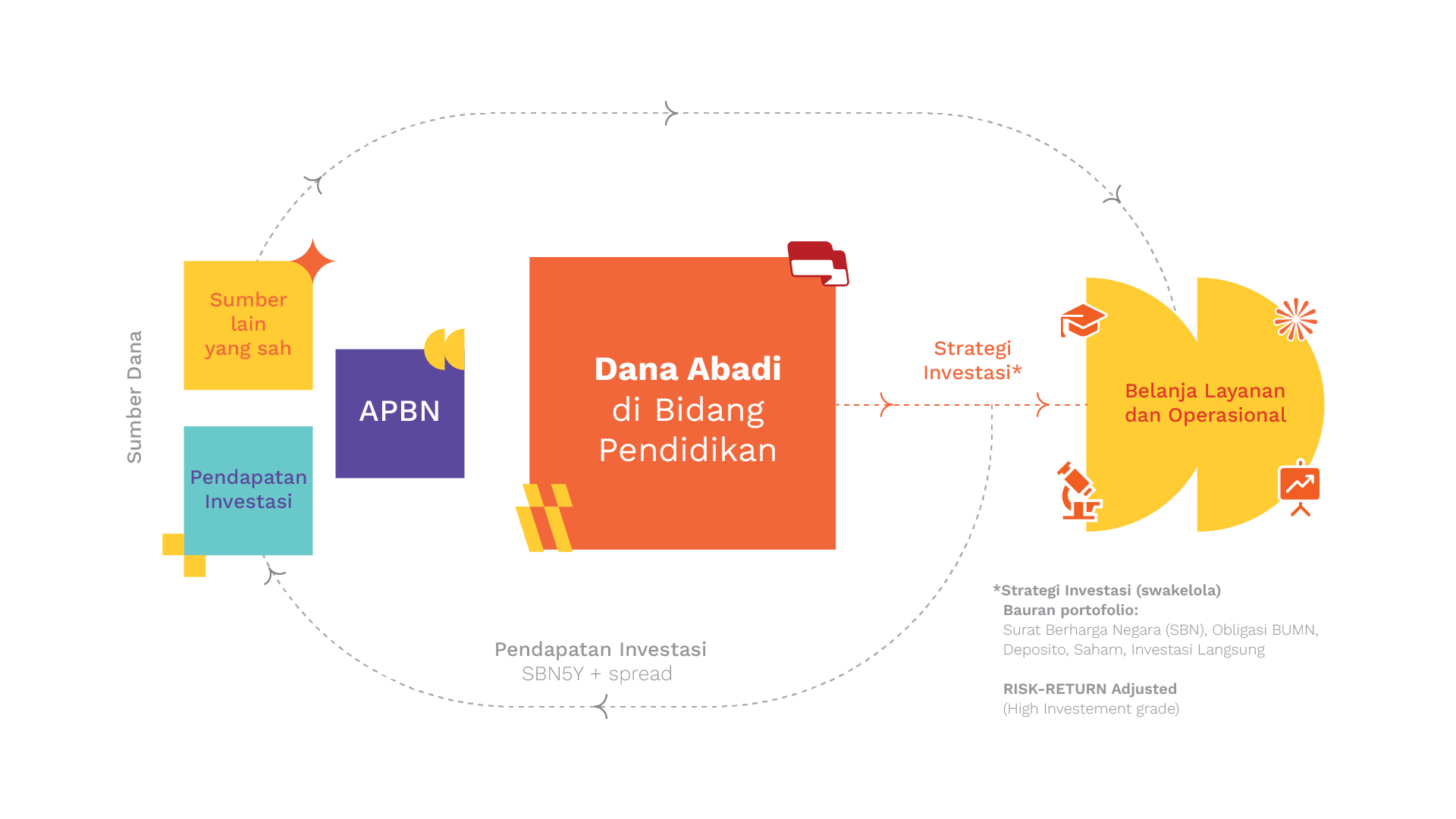

The scheme for LPDP fund development and service financing is described as follows:

Investment Policy

The LPDP Fund Development Services invest in deposits, government bond (SUN), and SOE bonds. The investment scheme maintains the nominal stability of the endowment funds in the future. The returns on invested funds are reported as Non-Tax State Revenue (PNBP) used to finance LPDP services and operation. The scheme for LPDP fund development and service financing is described as follows: (illustration attached)

Risks and Returns

In carrying out investments, LPDP not only prioritizes the expected returns, but also considers possible risks, especially the risks of declines in investment principal values.

Liquidity

Liquidity means that LPDP must consider the ease with which instruments can be converted into ready cash within certain period of time

Time Horizon

Investments are carried out in instruments with the right time frame, whether short-term and/or long-term.

Market Timing

LPDP should consider the right time to decide to buy and/or sell instruments, thereby minimizing risks and maximizing the expected returns

DiversificationIn carrying out investments, LPDP does not invest the managed funds in single instrument and/or in sole party. It invests the funds in diverse instruments to minimize risks (potential loss) and/or maximize the expected returns.